Why Property Maintenance Costs Kill Profitability and How Accounting Controls Them

- WPM Accounting

- Dec 1, 2025

- 7 min read

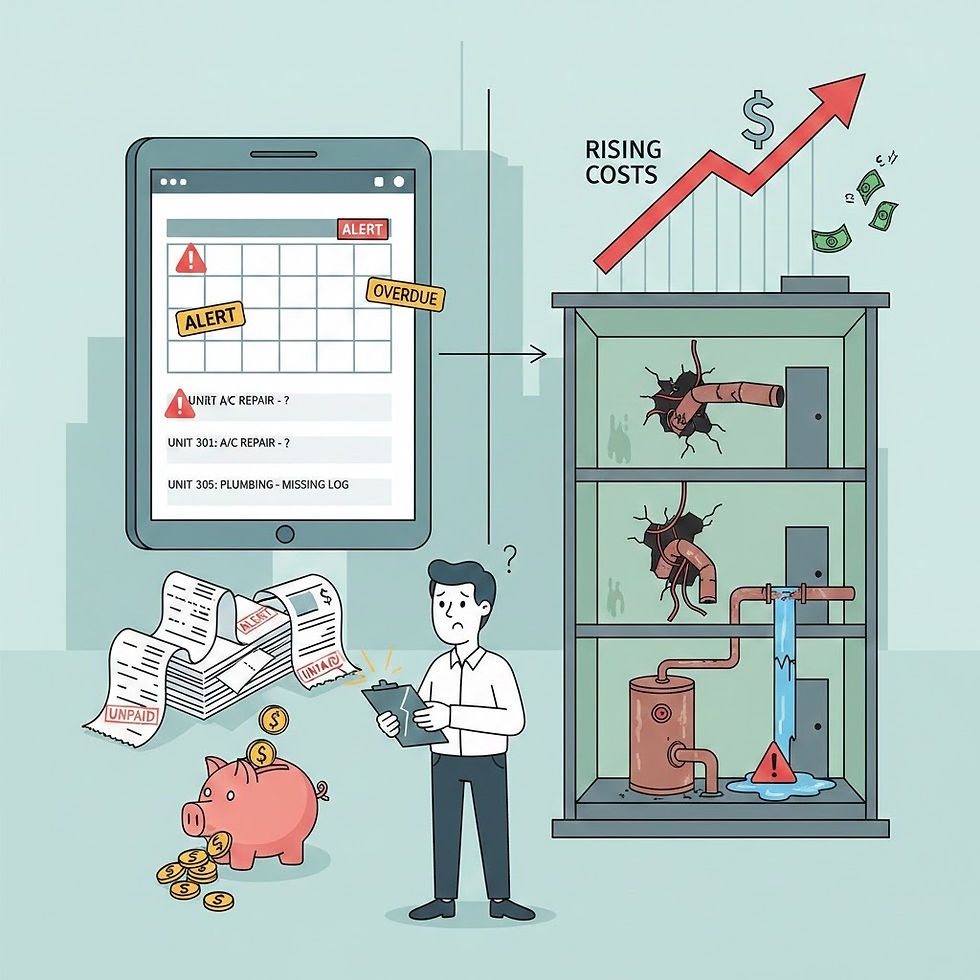

Property managers work hard to keep properties running smoothly, but nothing eats into profits faster than maintenance costs that spiral out of control. One repair becomes two, then three, and before you know it, the entire month’s revenue is gone. Many managers feel the pressure because maintenance is unavoidable. What they do not always realize is that the real problem is not the repair itself. It is the lack of proper tracking, planning, and accounting behind it.

The truth is simple. Maintenance problems do not destroy profitability. Poor financial visibility does. Strong accounting can turn maintenance from a profit killer into a predictable part of your business. With clear bookkeeping data, property managers can identify waste, negotiate better vendor rates, budget with precision, and keep tenants satisfied. WPM Accounting sees this every day with the property management accounting services we provide to managers nationwide.

This article shows how you can take control of maintenance expenses using bookkeeping data and sound financial systems. You will learn why costs get out of hand, how accounting reveals hidden problems, and why outsourced support gives you a major advantage.

How Maintenance Costs Impact Property Management Profitability More Than You Think

Maintenance plays a major role in your business. Most managers view it as a necessary expense, but few realize how much it affects overall financial performance. Repairs touch everything. Tenant satisfaction, renewal decisions, cash flow stability, vendor relationships, and even property value. This section explains the real financial weight of maintenance and why many managers underestimate its true cost.

Maintenance does more damage to profitability when it becomes reactive rather than planned. A simple leak left untreated turns into a costly drywall and flooring repair. HVAC systems without regular servicing break down during peak season when emergency service rates are higher. Turnovers become more expensive because wear and tear was not monitored closely enough. The more reactive the repairs, the higher the bill. This domino effect is common in property management, and it hits managers hardest when financial tracking is weak.

Profits also suffer when maintenance spending is not accurately recorded. Without precise data, property managers cannot identify patterns. They miss signs of recurring issues or overpriced vendors. Tenants also feel the impact. Slow repairs or unresolved issues push them to move out, creating more turnover costs. The phrase time is money applies here because every day that a repair is delayed creates extra cost or lost rent. When you look closely at maintenance through the lens of bookkeeping, you see how strongly it influences every part of your financial performance.

Before moving into the next section, it is important to understand this key insight. Maintenance expenses become unpredictable and costly not because repairs are unavoidable, but because accountability and tracking are often missing behind the scenes. Good accounting turns unpredictable costs into manageable ones.

Why Property Managers Lose Money on Unexpected Repairs and Poor Tracking

Unexpected repairs often come with warning signs that go unnoticed. Property managers lose money when these signs are missed and repair data is not logged accurately. Poor tracking of maintenance issues leads to unnecessary expenses and small bookkeeping gaps can create large financial losses.

When maintenance issues are not tracked properly, recurring problems are harder to identify. A water heater that keeps failing may be cheaper to replace than to repair repeatedly. Vendors charging above market rates can go unnoticed when invoices are not reviewed regularly. Delayed repairs increase long-term costs, turning minor problems into major expenses.

Missed documentation disrupts AP and AR workflows. Invoices that do not match work orders create messy accounting. Owners may question expenses when supporting documents are incomplete, slowing payments and creating tension. Errors in owner statements damage trust and credibility. Many property managers underestimate how much bookkeeping impacts operations until these issues stack up.

Structured accounting prevents small issues from turning into major profit drains and keeps unexpected repair costs under control.

What Financial Data Reveals About Rising Maintenance Costs

Financial data is a powerful tool for property managers. It provides a clear picture of where money goes, why expenses increase, and where savings are possible. Many managers rely on gut feelings to judge maintenance problems, but bookkeeping provides the hard evidence needed to make confident decisions.

Bookkeeping records highlight patterns that would otherwise go unnoticed. Repeated repairs on the same unit or system indicate when replacement is more cost effective than continuous repairs. Reviewing past invoices side by side makes vendor comparisons easier and uncovers opportunities to negotiate better pricing. Financial reports also reveal seasonal trends, such as AC repairs spiking during hotter months, helping managers plan ahead. They show how turnover affects maintenance costs and clarify expenses for make-readies, pinpointing which units drain the budget. Proper bookkeeping distinguishes between routine maintenance and major repairs, which is essential for accurate budgeting and forecasting.

Accurate financial data transforms maintenance from a guessing game into a measurable, controlled part of the business, enabling managers to make informed decisions that protect profitability.

How Proper Accounting Helps You Control Maintenance Spending

Accounting is the backbone of cost control. With strong processes, maintenance becomes predictable and manageable. This section explains how proper accounting systems help property managers stay ahead of expenses, reduce waste, and improve their decision making.

Proper accounting provides structure. It organizes invoices, work orders, vendor payments, and budgets. Below are essential ways accounting brings maintenance spending under control.

Clear invoice tracking prevents duplicate charges. Each invoice is matched with a work order. This keeps records clean and eliminates unnecessary billing disputes.

Vendor comparisons become easier with documented cost history. You can see who provides fair pricing and who does not. This makes vendor selection more strategic and cost efficient.

Regular reconciliations keep maintenance expenses accurate. Reconciliation ensures that every bill matches the ledger. This prevents surprises at the end of the month.

Financial clarity helps prioritize repairs by urgency and cost. Managers can identify what needs immediate attention. They also see what can be scheduled for later.

Accurate records reduce owner disputes. When documentation is complete, owners trust your financial reporting. This builds long term confidence in your management.

Real time data shows which properties need closer oversight. You can spot high cost properties quickly. This helps managers intervene early and reduce future losses.

Once accounting provides these insights, the next question is whether budgeting and forecasting make an even bigger difference.

Can Better Budgeting and Forecasting Reduce Maintenance Expenses?

Budgeting and forecasting give property managers a financial map. They make maintenance predictable instead of chaotic. With a solid financial plan, managers can set aside funds for seasonal repairs, unit turnovers, and major system replacements.

Budgeting helps managers anticipate expenses instead of reacting to them. When you know which repairs usually occur during certain months, you can plan your spending more accurately. Forecasting also helps identify when large projects may be needed, such as roof replacements or major HVAC upgrades. This prevents financial shocks because you can prepare months in advance. Property managers who use structured budgeting tend to have smoother operations and fewer emergencies.

Maintenance becomes part of the plan, not a disruption. Clear budgets also help managers communicate better with owners. When owners understand upcoming costs, trust increases and disputes decrease. Forecasting also highlights areas where preventative maintenance can save large amounts of money. It encourages managers to act early instead of waiting for something to break. Good budgeting makes your entire operation more stable, predictable, and profitable.

This brings us to one of the strongest solutions available. Outsourcing your accounting.

Why Outsourced Accounting Gives Property Managers Stronger Cost Control

Many property managers try to handle bookkeeping on their own, but the workload grows quickly. Outsourced accounting gives you a team of experts who manage the numbers while you focus on tenants and operations. This section explains why outsourcing offers better cost control, accuracy, and peace of mind.

Outsourced accounting is not just about convenience. It provides deeper financial oversight and stronger protection against errors. Here are the benefits.

Experts track every maintenance expense with precision.

This gives you accurate and updated financial records. Nothing slips through the cracks.

You gain access to specialized systems for property management accounting.

These systems improve reporting quality. They also integrate smoothly with platforms like AppFolio, Propertyware, and Rentvine.

Outsourcing helps reduce administrative strain on your in house team.

Your staff can focus on operations. The accounting team handles the rest.

More accurate data leads to smarter maintenance planning.

You can detect cost patterns faster. This helps reduce long term expenses.

Financial statements become clearer for owners and stakeholders.

Better reporting builds stronger relationships. It also helps with strategic decision making.

Partnering with WPM Accounting or using virtual bookkeeping for landlords can dramatically improve your control over maintenance.

Conclusion: Actionable Ways to Take Back Control of Maintenance Costs

Maintenance costs do not have to crush your profitability. The key is financial clarity. Strong accounting systems help you understand where your money goes, why expenses rise, and how to control them. Property managers who rely on structured bookkeeping are more prepared, more organized, and more profitable.

Here are the most important takeaways.

Accurate bookkeeping reveals hidden patterns in maintenance spending.

Proper tracking reduces unexpected repair costs.

Budgeting and forecasting turn unpredictable repairs into manageable expenses.

Outsourced accounting provides expert oversight and reduces errors.

Better financial insight keeps tenants satisfied and owners confident.

If you want to protect your profits, start with your accounting. The numbers tell the truth, and they guide every smart decision you make.

Frequently Asked Questions About Maintenance Costs in Property Management

What are the biggest maintenance costs that reduce profitability in property management?

The most expensive issues usually come from HVAC failures, plumbing problems, roofing repairs, and unit turnovers. These costs increase because they involve labor, materials, and emergency service fees. Strong financial tracking helps managers anticipate these expenses early.

How does accounting help property managers track and lower repair expenses?

Accounting organizes invoices, work orders, and vendor payments, giving you a clear view of spending. This transparency helps identify overpriced vendors and recurring issues. With accurate data, managers can make better decisions that reduce long term costs.

Can outsourcing accounting improve maintenance budgeting and forecasting?

Yes, outsourced accounting teams offer expert analysis and detailed reporting. This helps managers build stronger budgets and more accurate forecasts. Better planning reduces unexpected repairs and increases profitability.

What financial reports help identify costly maintenance issues early?

Expense reports, vendor summaries, budget versus actual statements, and maintenance category breakdowns show where money is going. These reports highlight trends and reveal areas that need attention. Reviewing them regularly helps prevent small issues from becoming larger ones.

How often should property managers review maintenance related bookkeeping data?

Most experts recommend reviewing data monthly. High volume portfolios may need weekly reviews for timely decision making. Frequent reviews help managers stay ahead of problems and control spending more effectively.

Comments